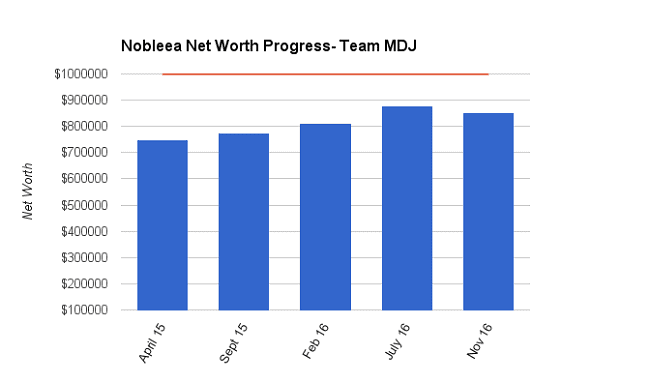

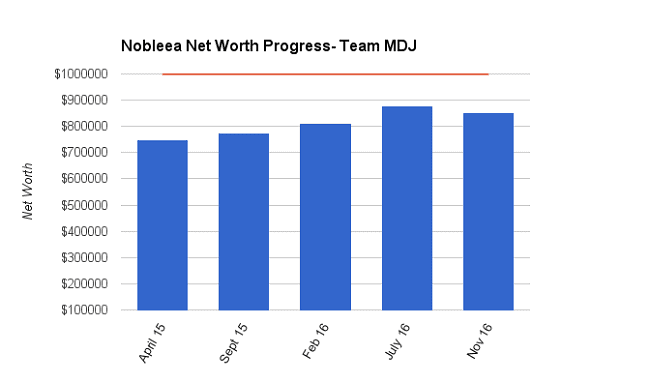

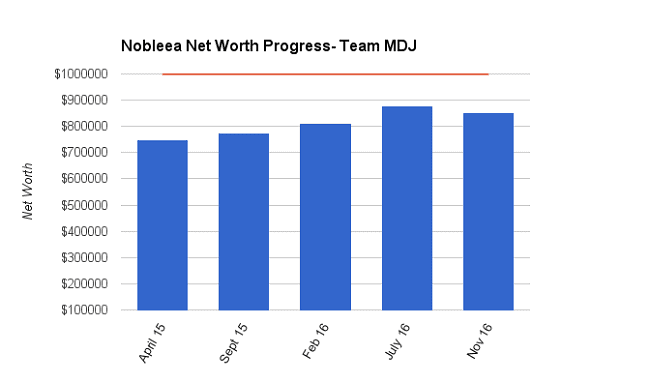

Welcome to the Million Dollar Journey November 2016 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. Nobleea – the Oil and Gas Engineer, was selected as a team member and will post net worth updates on a quarterly basis. Here is more about Nobleea.

- Name: nobleea

- Age: 38

- Net Worth: $850,844

- Day Job: Engineering manager at oilfield services company, Teacher (wife)

- Family Income: $130,000 (main job), $10,000 (part time job), $80,000 (wife main job), $5,000 (wife part time job)

- Goals: Million dollar family net worth before 40, Retirement from primary job at 50 (for me)

We live in Edmonton where incomes are decent and housing prices are fairly reasonable. Some may roll their eyes at the high family income and say that a million dollar journey is going to be pretty easy. I have a plan to retire at 50 and pursue other interests. My wife will likely continue working until it makes sense to retire with her DB pension as the penalties for early retirement are pretty severe. We moved in to our new custom built house a few months ago and are just getting all the final bills cleared up now.

Our goals for 2016 are varied, but our financial ones include: contributing 30K to our TFSA; moving in to our new house and selling our old one for $475K or more; tracking utility consumption on the current and new house; and, tracking and reducing our monthly spend in a variety of categories. The end goal is to have a reasonable budget by the middle of the year. The TFSA is invested in a mix of 85% couch potato ETF’s and the remaining blue chip stocks. Looking at these goals, we have already completed the majority of them.

Since the last update, we’ve moved some of the TFSA money around. Part of it was contributed to an RRSP and part was used to pay the final house build bill which was more than we were expecting; though I understand that is par for the course for a custom build. Our final tally was about 14% higher than the original estimate and maybe 1 month behind the original scheduled. On the RRSP, we can expect a tax refund on the order of $16K next March.

One of our goals for the year was tracking utility consumption in our old and new house. There was a fair amount of design and construction modifications to make the new house more energy efficient. Our 5 year average consumption in our old house were Power 513kWh/month, Water 12m3/month, Natural Gas 6GJ/month. The average Edmonton household uses 600kWh/mo, 16m3/month water, and 10GJ/month so I was happy to see were were under those.

Our new house is significantly larger, but much better insulated, sealed, constructed, and designed with passive solar concepts in mind. I am hoping for a drop in our utility consumption. Three months in, it looks like we will certainly be dropping our water consumption. Power looks to be the same or marginally lower. Gas consumption is hard to tell as there’s been a lot of variation since the start. We’ll have a better picture by the time the next net worth update rolls around.

We are still on single furlough at work (10% reduction), but they’ve indicated it will end this year, so that will help offset the reinstatement of full CPP and EI deductions that starts in January. Our business is healthy and we have started hiring again.

The drop in the net worth for this update is almost exclusively due to the final bill for the house. Additionally, we booked a holiday to Hawaii for February, so flights and accommodations are paid for and that is not an insignificant amount.

We are still waiting for our second child to show up. He/she is due this week. Our daughter’s RESP is healthy and has a balance of about $11,650 though the value is not included below. It is invested in TD e-series. She is almost 3.

It looks like we will pass the Million dollar mark late next year (2017), which would be before my stated goal of age 40. In May 2009, when we started tracking net worth in earnest, the value was

$136,377.

Net worth numbers (Quarter/Quarter):

Assets: $1,623,264 (-11.78%)

- Cash: $5,781

- Registered/Retirement Investment Accounts (RRSP): $204,701 (+40%)

- Non-Registered Accounts: $65,000 (new)

- Tax Free Savings Accounts (TFSA): $0 (-100%)

- Defined Benefit Pension: $172,000 (+13.1%)

- Principal Residence: $1,130,000 (new)

- Vehicles/Other: $45,782 (-3.0%)

Liabilities: $772,420 (-19.6%)

- Mortgage: $760,500 (-18.7%)

- Credit Cards: $11,920 (-53%)

Total Net Worth: $850,844 (-3.2%)

- Started 2015 with Net Worth: $717,634

- Gain/Loss to Date: +18.5%

Some quick notes and explanations to common questions:

The Cash

Cash includes bank account balances in two accounts, plus any gift card balances. When not building a house, we use cash flow modeling to predict the maximum amount we can put towards debt/investments today without having a negative balance in the future, taking all one time or non-regular bills in to account.

Loans and Credit Cards

The credit cards are paid off in full every month with no interest due. We put all our expenses on credit cards for cash back. As this can be a substantial amount some months, I believe it needs to have a line item in your monthly net worth as it is a liability at that snapshot in time.

Savings

TFSA’s will need to be replenished over the next 5 years.

Real Estate

We moved in to our new build in July and have been settling in. I still have to finish out the suite above the detached garage to get it ready for rental. The near/mid term plan is to do some spec infill in and around our neighbourhood. The non-registered account is considered seed money for this. It is something I have always wanted to do. I would need some more seed money to do it properly, or partner with a friend.

|