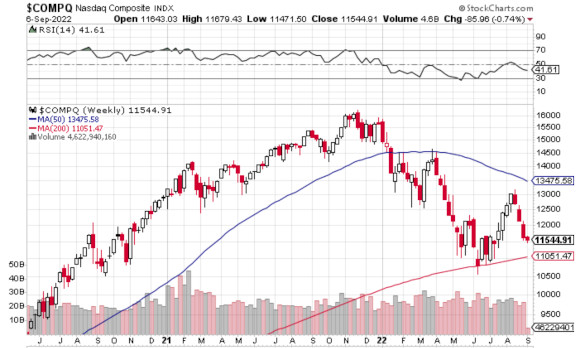

Source: StockCharts NASDAQ Composite Index

US stocks are floundering, with substantial declines reported in 2022. After multiple years of strong gains, the NASDAQ, Dow Jones, and S&P 500 Index have reversed course. Indeed, the pandemic, invasion of Ukraine, and massive government expenditure have ravaged the US economy with stocks getting pummeled six ways from Sunday.

For the YTD, the NASDAQ is down 27.08% (-4,287.89), the Dow Jones is down 14.87% (-5,439.76), and the S&P 500 Index is down 18.52% (-888.37). Given these substantial declines, investors have experienced dramatic losses in their 401(k)s.

Source: INDEXCBOE: VIX

Markets have sold off en masse, with 52-week lows being tested in 2022. As the charts reflect, a strong downward bias is evident across the board. While the 50-Day moving averages are higher than the 200-Day moving averages, these trends hardly inspire confidence in a largely depressed market.

Of particular concern is the state of the US economy, vis-à-vis inflationary pressures. With the purchasing power of every USD being squeezed from all sides, stocks are looking unappealing at the present. The VIX has experienced peaks and troughs throughout 2022, but a notable trend since June 2022 has been a decline from 34.02 to a mid-August low of 19.56.

Capitalizing Off the Perks: How Seasoned Traders Make their Play

Savvy traders are privy to a variety of VIP-style benefits that everyday market participants are unaware of. For example, those on the inside get access to rapid transactions, personal managers, and insider tips on the latest buzz. Much like any prestigious VIP casino Program where benefits accrue, it pays to leverage your financial activity. While trader benefits are limited to news on stocks, bonds, commodities, indices, forex and crypto movements, there are always many extra benefits for those on the inside.

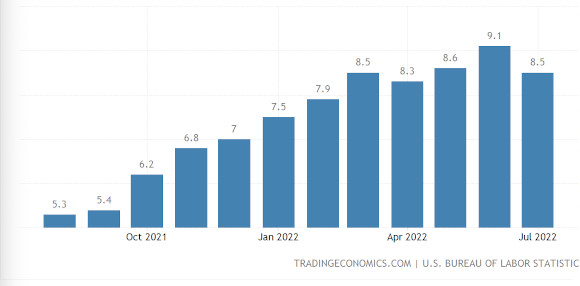

But let’s get back to the markets. In recent weeks, market volatility has increased sharply with rising interest rates. Increased volatility tends to foreshadow a risk-off approach to stocks. This reflects in terms of current stock market performance. As inflation indicators remain high, stocks are coming in for some tap. According to the market indicators, the US inflation rate dipped from June (9.1%) to July (8.5%), but multi-decade highs are being tested.

Source: Trading Economics | US Bureau of Labor Statistics

The recent MoM (Month on Month) inflation rate was measured at 0.00, with a previous figure of 1.30%. Large spikes in energy costs, food costs, and commodities are pushing inflation higher. While it is certainly positive that inflation tapered from June 2022 to July 2022, peeling off 40-hear highs, the figures remain excessively high. A major consideration during inflationary times is how stocks perform.

Inflation is best described as ‘Steadily increasing prices where too much money is chasing too few goods and services. This erodes the purchasing power of your money.’ To reign in excessive price spikes, the Federal Reserve Bank raises interest rates. The process of raising rates serves as a restriction on economic activity. By making money more expensive (via credit facilities), it is hoped that the Fed can slam the brakes on runaway inflation.

But stock markets don’t react well to rising interest rates. Rising interest rates are designed to increase savings in the economy. This reduces excess demand and causes investors to shift from equity to debt. As interest rates increase, the risk-reward ratio declines. The Fed must act responsibly by hiking rates in accordance with rising inflation to stem the tide. Rising rates mean that companies are having to pay more on borrowed money. This erodes the bottom line.

Investors are choosing less risky investments with guaranteed inflation-beating returns such as i-Series bonds (currently 9.62% per annum through October 2022). Equities are calculated according to discounted projected cash flows. History suggests that stock markets tend to deliver poorly during inflationary periods. The Fed’s targeted inflation rate is 2%, but we’re currently over 4X higher than that. For now, we can expect rising prices to reflect favorably in terms of nominal GDP growth, which belies real GDP growth.